Featured

Table of Contents

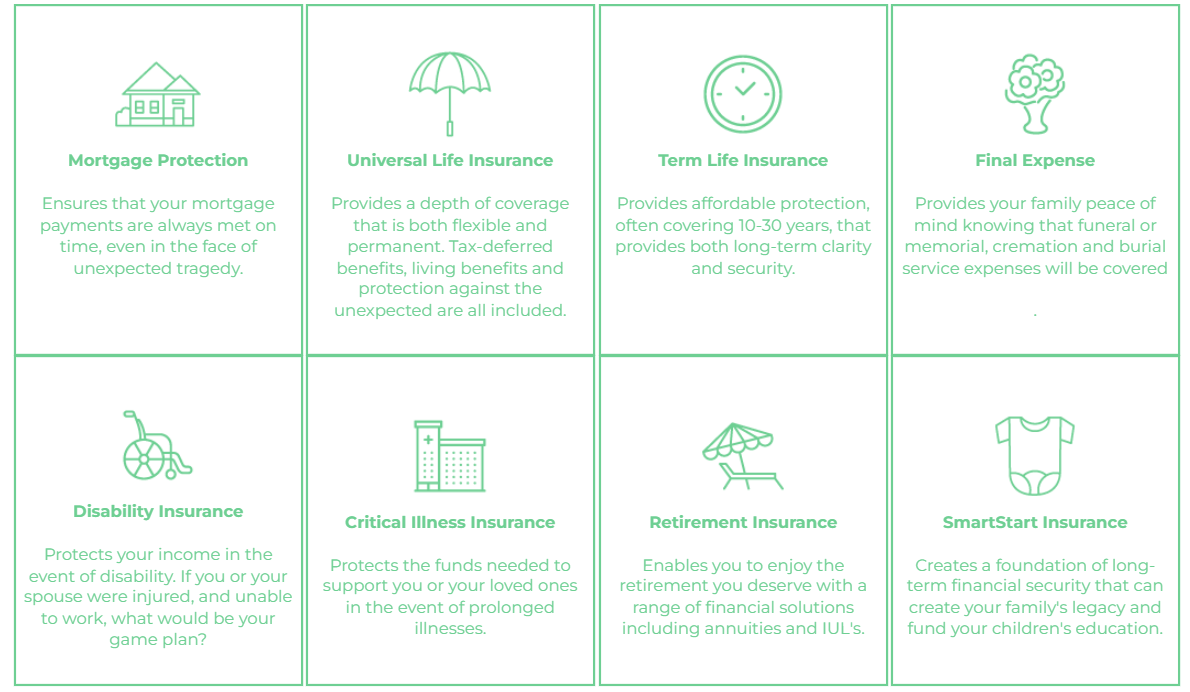

Maintaining all of these phrases and insurance policy types directly can be a migraine. The following table positions them side-by-side so you can quickly distinguish amongst them if you get confused. An additional insurance policy protection type that can repay your home loan if you pass away is a typical life insurance plan

A is in location for a set number of years, such as 10, 20 or 30 years, and pays your recipients if you were to pass away throughout that term. An offers coverage for your entire life period and pays out when you pass away.

One usual general rule is to aim for a life insurance plan that will pay up to 10 times the insurance policy holder's income quantity. Additionally, you could select to make use of something like the cent technique, which adds a family members's debt, revenue, home loan and education and learning expenditures to determine just how much life insurance coverage is required (decreasing insurance life mortgage term).

It's also worth noting that there are age-related limits and thresholds imposed by virtually all insurance firms, who commonly won't give older purchasers as numerous choices, will certainly charge them much more or may deny them outright.

Below's how mortgage protection insurance coverage determines up against conventional life insurance coverage. If you have the ability to get approved for term life insurance policy, you should prevent mortgage protection insurance policy (MPI). Contrasted to MPI, life insurance coverage provides your household a more affordable and extra adaptable advantage that you can count on. It'll pay out the same quantity anytime in the term a death happens, and the cash can be used to cover any type of expenses your family deems required during that time.

In those situations, MPI can provide fantastic tranquility of mind. Every mortgage defense alternative will have countless regulations, policies, benefit choices and disadvantages that require to be weighed carefully against your precise circumstance.

Mortgage Insurance Why Do I Need It

A life insurance policy plan can assist pay off your home's home loan if you were to die. It is among several means that life insurance policy might assist protect your loved ones and their economic future. Among the ideal methods to factor your home mortgage right into your life insurance policy demand is to chat with your insurance coverage agent.

Rather than a one-size-fits-all life insurance coverage plan, American Family members Life Insurance provider supplies plans that can be made particularly to fulfill your family's needs. Below are some of your options: A term life insurance policy policy. mortgage protection insurance services inc is energetic for a details quantity of time and typically offers a bigger quantity of coverage at a lower price than an irreversible policy

Instead than just covering an established number of years, it can cover you for your whole life. It additionally has living benefits, such as cash money value buildup. * American Family Members Life Insurance policy Firm supplies different life insurance policies.

Your agent is a terrific resource to address your questions. They may likewise be able to help you discover voids in your life insurance policy protection or brand-new methods to minimize your other insurance coverage. ***Yes. A life insurance policy recipient can pick to make use of the survivor benefit for anything - mpi insurance online. It's a fantastic method to assist secure the economic future of your family if you were to pass away.

Life insurance policy is one means of helping your household in repaying a home loan if you were to pass away before the home loan is entirely repaid. No. Life insurance policy is not necessary, however it can be a vital part of assisting make sure your loved ones are economically safeguarded. Life insurance coverage profits may be utilized to help settle a home loan, but it is not the exact same as home loan insurance that you could be called for to have as a problem of a loan.

What Does Mortgage Insurance Do

Life insurance policy may assist guarantee your residence remains in your family by supplying a death benefit that might assist pay down a mortgage or make crucial acquisitions if you were to pass away. Call your American Household Insurance coverage representative to talk about which life insurance policy policy best fits your requirements. This is a brief summary of protection and goes through plan and/or rider terms and conditions, which might differ by state.

Words lifetime, long-lasting and irreversible are subject to policy conditions. * Any lendings taken from your life insurance plan will accumulate interest. mortgage and life cover. Any outstanding finance equilibrium (loan plus rate of interest) will certainly be deducted from the fatality advantage at the time of insurance claim or from the cash worth at the time of abandonment

Discounts do not use to the life plan. Policy Kinds: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Home mortgage security insurance (MPI) is a different kind of protect that could be valuable if you're not able to settle your home mortgage. While that extra security appears good, MPI isn't for everybody. Below's when home loan defense insurance coverage deserves it. Home loan security insurance is an insurance policy that settles the rest of your home mortgage if you die or if you become handicapped and can't work.

Both PMI and MIP are needed insurance coverage coverages. The quantity you'll pay for home loan protection insurance policy depends on a variety of elements, including the insurance company and the existing equilibrium of your home loan.

Still, there are benefits and drawbacks: Most MPI policies are issued on a "guaranteed acceptance" basis. That can be advantageous if you have a wellness condition and pay high rates for life insurance policy or battle to acquire coverage. mortgage payment protection insurance companies. An MPI plan can supply you and your family members with a feeling of safety and security

Mortgage Insurance Ge

You can choose whether you need home loan security insurance and for exactly how long you need it. You could want your home mortgage protection insurance coverage term to be close in size to exactly how long you have left to pay off your home mortgage You can terminate a home loan protection insurance policy.

Latest Posts

Senior Burial Insurance

Funeral Expenses Insurance

Funeral And Burial Life Insurance